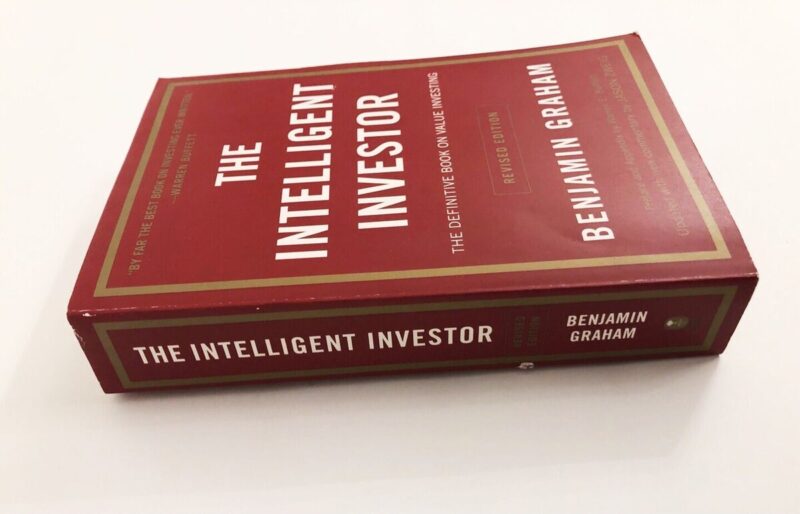

Book Review: The Intelligent Investor by Benjamin Graham

First published in 1949, The Intelligent Investor by Benjamin Graham is widely regarded as the bible of value investing. Warren Buffett, one of Graham’s most famous students, called it “the best book about investing ever written.”

But is this decades-old classic still worth reading today? In this review, we’ll break down what the book covers, its key takeaways, pros and cons, and whether modern investors can benefit from Graham’s wisdom.

Book Details

- Title: The Intelligent Investor

- Author: Benjamin Graham

- Publisher: Harper Business (latest edition revised with commentary by Jason Zweig)

- First Published: 1949 (latest revised edition 2006)

- Length: 640 pages (depending on edition)

- Format: Hardcover, Paperback, Kindle, Audiobook

- Genre: Investing / Finance / Economics

Overview

Benjamin Graham, often called the father of value investing, wrote The Intelligent Investor to provide ordinary investors with timeless principles for managing money wisely, avoiding speculation, and building long-term wealth.

The book’s enduring relevance lies not in stock-picking tips, but in its framework for rational investing — focusing on discipline, margin of safety, and understanding the difference between investment and speculation.

Key Lessons & Takeaways

1. Investment vs. Speculation

Graham draws a clear line: investing is based on careful analysis, seeking safety and adequate returns, while speculation is essentially gambling. Most investors mix the two without realizing it.

2. Margin of Safety

Perhaps the book’s most important concept: only buy investments at a price significantly below their intrinsic value, to protect against errors, volatility, and uncertainty.

3. Mr. Market Analogy

Graham introduces “Mr. Market” — a metaphor for stock market behavior. Mr. Market is moody, sometimes euphoric, sometimes depressed, offering shares at different prices daily. The intelligent investor doesn’t follow his moods but takes advantage of them.

4. Defensive vs. Enterprising Investor

Graham separates investors into two types:

- Defensive investors: prefer safety, low effort, and diversified portfolios.

- Enterprising investors: willing to put in more work, research, and accept risk for potentially higher returns.

5. The Importance of Discipline

Successful investing is less about brilliance than about emotional control, patience, and sticking to a sound strategy over the long term.

6. Avoiding Speculative Frenzies

The book warns against chasing trends, fads, and bubbles — lessons that remain incredibly relevant in the age of crypto, meme stocks, and speculative tech booms.

Pros & Cons

✅ Pros

- Timeless wisdom — core principles remain relevant 70+ years later.

- Clear framework — teaches discipline, safety, and long-term thinking.

- Highly respected — endorsed by Warren Buffett and other legendary investors.

- Updated commentary in newer editions by Jason Zweig links concepts to modern markets.

❌ Cons

- Dense and technical — not as accessible for complete beginners.

- Lengthy — at 600+ pages, it requires patience and focus.

- Outdated examples — some case studies reference industries and companies no longer relevant.

Who Should Read The Intelligent Investor?

This book is best suited for:

- Intermediate to advanced investors who want to strengthen their foundations.

- Serious beginners prepared to work through a dense but rewarding classic.

- Anyone interested in value investing or Warren Buffett’s philosophy.

- Investors seeking long-term, disciplined strategies, not quick tips.

If you’re completely new to finance, you might want to start with a lighter personal finance book before tackling Graham.

Reception & Legacy

- Over 1 million copies sold worldwide.

- Warren Buffett has praised it repeatedly as his all-time favorite investing book.

- Still frequently recommended in modern lists of the best investing and finance books ever written.

Its enduring popularity shows that Graham’s ideas transcend time — making it just as relevant in today’s volatile markets as in the post-Depression era.

Final Verdict: Is It Worth Reading?

Yes — if you’re serious about investing.

While not the easiest read, The Intelligent Investor offers principles that never expire: discipline, safety, patience, and rationality. If you want to learn how to think about investing rather than chase hot tips, this book is indispensable.

👉 Best for serious learners who want to build lasting wealth the smart way.

Quick Summary

Rating: ★★★★☆ (4.7/5)

Title: The Intelligent Investor

Author: Benjamin Graham

Publisher: Harper Business (latest edition 2006)

Length: 640 pages

Best For: Serious investors, value investors, Buffett followers