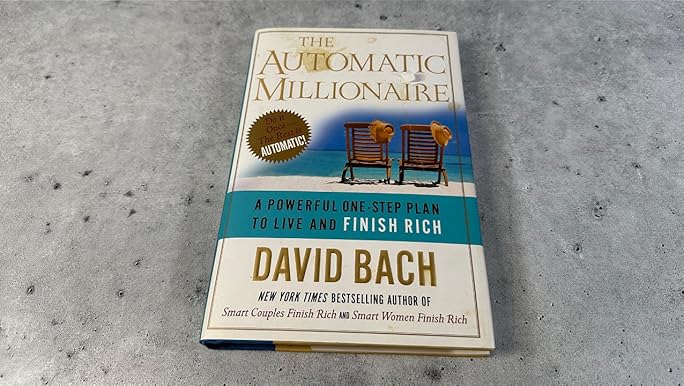

Book Review: The Automatic Millionaire by David Bach

Many personal finance books promise wealth, but few make it feel achievable without radical lifestyle changes. The Automatic Millionaire by David Bach does exactly that, providing a simple, practical framework for building wealth over time—without complicated investing strategies or massive income.

First published in 2004, this book remains widely read, recommended, and cited by financial advisors. But in 2025, with evolving financial tools and apps, is Bach’s advice still relevant? Let’s dive into this in-depth review.

What Is The Automatic Millionaire About?

At its core, The Automatic Millionaire is about leveraging automation to achieve financial security and wealth. Bach argues that the key to becoming a millionaire is making saving and investing automatic, so you don’t rely on discipline alone.

The book walks readers through strategies like:

- Automatic contributions to retirement accounts

- Automatic savings accounts for bills and emergencies

- Pay-yourself-first systems to ensure consistent wealth-building

Bach combines personal anecdotes, practical steps, and motivational advice, making complex financial concepts easy for anyone to implement.

Key Lessons from The Automatic Millionaire

1. Automate Everything

The book’s central thesis: set up systems that handle money automatically. Automation removes the human factor—no temptation to skip saving or investing.

2. Pay Yourself First

Before paying bills or spending on discretionary items, allocate a portion of your income to savings or investments. This principle ensures your wealth grows consistently.

3. The Power of Compounding

Even small, consistent contributions grow significantly over time. Starting early—even with modest amounts—can create substantial wealth.

4. Eliminate Bad Debt

Debt is the enemy of wealth. Bach emphasises paying off high-interest debt and avoiding liabilities that drain cash flow.

5. Homeownership as a Wealth Tool

The book highlights the value of owning your home outright and using it as a cornerstone for building financial stability.

6. Keep It Simple

You don’t need complex investment strategies or high income to become wealthy. Bach demonstrates that discipline and automated systems outperform high-risk financial maneuvers.

Who Should Read The Automatic Millionaire?

- Young professionals who want a clear path to wealth without overthinking finances.

- Middle-class earners looking for practical, achievable steps to financial independence.

- People struggling with discipline in budgeting and saving.

- Readers who prefer systems over theory—this book shows exactly what to automate.

It may be less useful for advanced investors seeking nuanced strategies or alternative investment vehicles.

Pros & Cons of The Automatic Millionaire

✅ Pros

- Clear, actionable advice that anyone can implement immediately.

- Emphasises automation and systems, reducing reliance on willpower.

- Motivational and easy-to-read narrative style.

- Focuses on both wealth-building and debt reduction.

❌ Cons

- Some advice (like homeownership) may not be realistic for all readers in 2025.

- Less depth on investments beyond mutual funds and retirement accounts.

- Some anecdotes feel dated in today’s digital-first financial landscape.

- Limited focus on entrepreneurial income streams compared to Rich Dad Poor Dad.

How It Compares to Other Personal Finance Books

| Book | Focus | Best For | Style |

|---|---|---|---|

| The Automatic Millionaire | Automation, paying yourself first | Beginners, disciplined savers | Practical, step-by-step |

| Rich Dad Poor Dad | Mindset & financial education | Beginners, entrepreneurs | Storytelling, motivational |

| The Millionaire Next Door | Habits & traits of the wealthy | Savers, disciplined earners | Research-based, analytical |

| Atomic Habits | Habit-building & behaviour change | Anyone wanting discipline | Practical, science-based |

Whereas Rich Dad Poor Dad focuses on mindset and The Millionaire Next Door focuses on habits and frugality, The Automatic Millionaire is all about systems and automation—a concrete, step-by-step framework anyone can implement.

Is The Automatic Millionaire Still Relevant in 2025?

Absolutely. Even with modern banking apps, robo-advisors, and budgeting software, the principles of automation, pay-yourself-first, and debt elimination are timeless. In fact, today’s technology makes implementing Bach’s system easier than ever, with tools like YNAB, Plum, Emma, Snoop, and Mint alternatives helping automate savings, bill payments, and investments.

Final Verdict

The Automatic Millionaire is a practical, motivating guide for anyone who wants financial security without complexity. Its strength lies in making wealth-building achievable through simple, automated steps.

- 🏆 Best for: Beginners, young professionals, and disciplined savers seeking actionable systems

- ⚠️ Not ideal for: Advanced investors or those seeking entrepreneurial strategies

Think of it as a bridge between mindset-focused books like Rich Dad Poor Dad and habit-focused books like Atomic Habits—it teaches you exactly what steps to automate to build wealth consistently.

Quick Summary

Best For: Beginners, young professionals, and anyone seeking a simple, systematic approach to wealth

Book Title: The Automatic Millionaire

Author: David Bach

First Published: 2004

Main Lesson: Automate your finances to consistently build wealth and eliminate debt

Rating: ★★★★☆ (4.5/5)