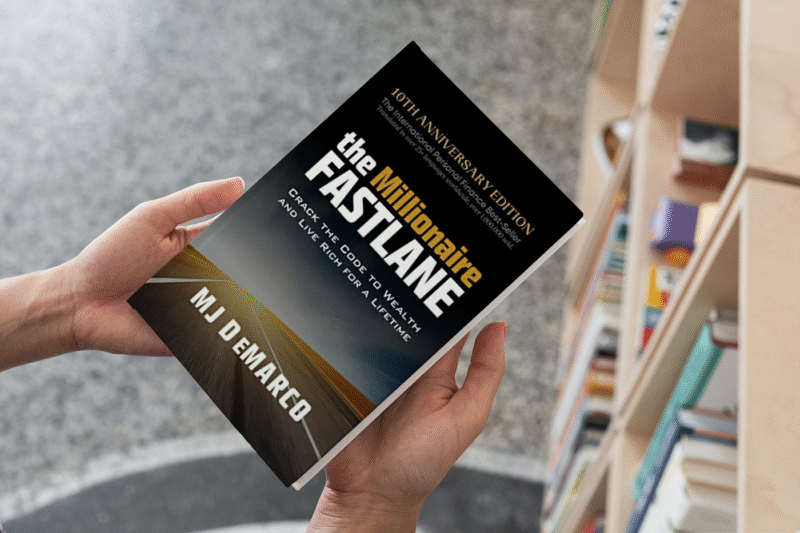

Book Review: The Millionaire Fastlane by MJ DeMarco

Many personal finance books focus on the slow-and-steady approach to wealth: save, invest consistently, retire decades later. MJ DeMarco’s The Millionaire Fastlane, first published in 2011, challenges that paradigm.

This book argues that true financial freedom isn’t achieved by slowly saving pennies over decades but by creating scalable systems and entrepreneurial ventures that accelerate wealth creation.

In this review, we’ll examine its core lessons, pros and cons, and whether it’s relevant for today’s aspiring entrepreneurs in 2025.

What Is The Millionaire Fastlane About?

The Millionaire Fastlane contrasts three approaches to wealth:

- The Sidewalk – Living paycheck-to-paycheck with little financial awareness.

- The Slowlane – Traditional “work hard, save, invest, retire at 65” path.

- The Fastlane – Leveraging business systems, scalable income, and entrepreneurship to achieve wealth quickly.

DeMarco stresses that financial freedom is a result of control, leverage, and value creation, not time alone. The book blends storytelling, personal anecdotes, and blunt advice to challenge conventional wisdom.

Key Lessons from The Millionaire Fastlane

1. Wealth Is Not About Income Alone

High income doesn’t equal wealth. True financial freedom comes from controlling assets and creating scalable value.

2. Avoid the “Slowlane” Mentality

Relying solely on 401(k)s, pensions, or slow compounding limits your wealth potential.

3. Leverage Systems and Entrepreneurship

Fastlane millionaires build businesses or investments that can scale without requiring linear time input—think scalable products, online businesses, or high-leverage investments.

4. Control Your Financial Destiny

Ownership and control over assets are central. Dependence on employers, banks, or the government limits freedom.

5. Mindset and Action Are Critical

Success requires discipline, risk-taking, and a willingness to challenge societal norms about money, work, and retirement.

Who Should Read The Millionaire Fastlane?

- Aspiring entrepreneurs seeking faster wealth-building paths.

- Individuals frustrated with traditional finance advice like “save 10% and retire at 65.”

- People open to taking calculated risks and thinking creatively about value creation.

It may be less relevant for conservative savers, those approaching retirement, or individuals seeking a step-by-step budgeting plan.

Pros & Cons of The Millionaire Fastlane

✅ Pros

- Highly motivational and contrarian perspective on wealth.

- Encourages entrepreneurship and value creation over passive saving.

- Practical examples of leverage, scalable income, and business mindset.

- Distills complex ideas into accessible concepts with strong storytelling.

❌ Cons

- Writing style can feel blunt or abrasive.

- Focused heavily on entrepreneurship—less practical for traditional employees.

- Some examples are anecdotal rather than data-driven.

- High-risk strategies may not suit all readers or financial situations.

How It Compares to Other Personal Finance Books

| Book | Focus | Best For | Style |

|---|---|---|---|

| The Millionaire Fastlane | Entrepreneurship, scalable wealth | Entrepreneurs, risk-takers | Motivational, contrarian, story-driven |

| The Millionaire Next Door | Habits & behaviours of millionaires | Savers, disciplined earners | Data-driven, research-based |

| Rich Dad Poor Dad | Mindset & financial education | Beginners, aspiring entrepreneurs | Storytelling, motivational |

| The Automatic Millionaire | Automation & systems | Beginners, disciplined savers | Practical, step-by-step |

Unlike The Automatic Millionaire, which emphasizes automated systems, The Millionaire Fastlane emphasizes control, leverage, and taking the driver’s seat in your wealth-building journey.

Is The Millionaire Fastlane Still Relevant in 2025?

Yes. While the world has evolved with apps, AI, and digital entrepreneurship, the principles of scalable wealth creation, ownership, and mindset remain critical for anyone looking to break free from the traditional slowlane approach.

In 2025, with opportunities in e-commerce, digital products, and online businesses, DeMarco’s Fastlane approach is arguably more actionable than ever.

Final Verdict

The Millionaire Fastlane is for readers willing to think differently about wealth, take calculated risks, and embrace entrepreneurship. It’s bold, motivational, and challenges conventional financial advice—but it requires action.

- 🏆 Best for: Entrepreneurs, risk-takers, and those seeking financial freedom faster

- ⚠️ Not ideal for: Conservative savers or readers seeking safe, traditional paths

Think of it as a complement to mindset-focused books like Rich Dad Poor Dad and habit-focused guides like Atomic Habits—it teaches not only how to think differently but how to act boldly to achieve wealth faster.

Quick Summary

Best For: Aspiring entrepreneurs, creative thinkers, and anyone seeking faster financial independence

Book Title: The Millionaire Fastlane

Author: MJ DeMarco

First Published: 2011

Main Lesson: Wealth comes from scalable systems, entrepreneurship, and taking control—not just saving over decades.

Rating: ★★★★☆ (4.5/5)