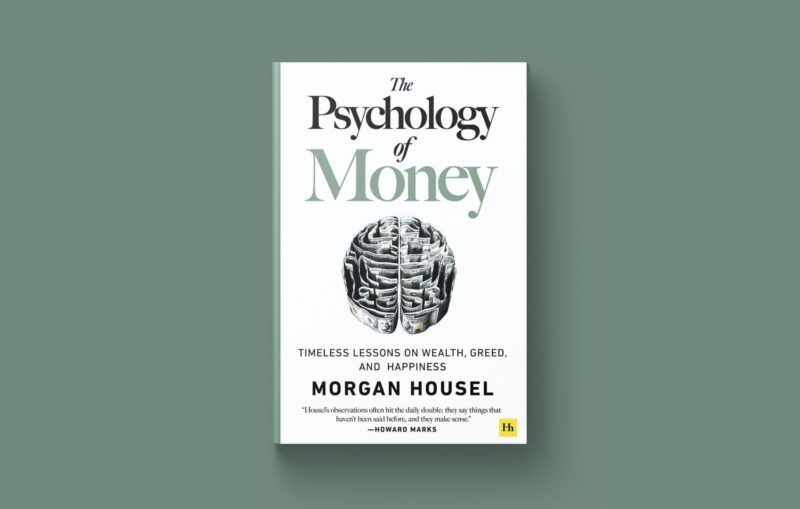

Book Review: The Psychology of Money by Morgan Housel

When it comes to money, the numbers are often simple — but our behaviour around money is anything but. In The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness, award-winning writer Morgan Housel explores the human side of personal finance, blending stories, history, and psychology to explain why financial success is more about behaviour than spreadsheets.

This review unpacks the book’s core lessons, strengths, weaknesses, and whether it’s worth a place on your bookshelf.

Book Details

- Title: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness

- Author: Morgan Housel

- Publisher: Harriman House

- Publication Date: September 8, 2020

- Length: 256 pages

- Format: Hardcover, Paperback, Kindle, Audiobook

- Genre: Personal Finance / Psychology / Self-Help

Overview

Unlike traditional personal finance books that focus on budgeting, debt payoff, or investment strategies, The Psychology of Money takes a different approach.

Morgan Housel argues that financial success depends less on what you know and more on how you behave. He illustrates this through 19 short stories and lessons drawn from history, business, and personal anecdotes.

The book’s central theme: managing money well is not about maximising returns, but about avoiding mistakes, understanding your relationship with risk, and building habits that last.

Key Lessons & Takeaways

1. It’s Not About Knowledge — It’s About Behaviour

Financial literacy is important, but Housel emphasises that discipline, patience, and emotional control matter more than knowing the latest investment hack.

2. The Power of Compounding

Wealth builds slowly. The book reminds readers that time is the greatest factor in investing success — staying consistent beats chasing quick wins.

3. We All See Money Differently

Our views on money are shaped by our personal experiences. Someone who grew up during a recession will view risk very differently from someone raised in a booming economy.

4. Enough Is a Powerful Word

Housel warns against the endless pursuit of “more.” Knowing when you have enough — and avoiding greed — is critical to living a happy and secure life.

5. Luck, Risk, and Humility

Success is not always purely skill, and failure is not always purely incompetence. Recognising the roles of luck and risk helps you make more balanced decisions.

6. Wealth Is What You Don’t See

Expensive cars, watches, and status symbols may look like wealth, but true wealth is the money you keep — savings, investments, freedom, and security.

7. Long-Term Thinking Wins

Patience, modest returns, and avoiding catastrophic mistakes are often the real drivers of wealth.

Pros & Cons

✅ Pros

- Unique perspective — focuses on money psychology, not technical tactics.

- Engaging storytelling — history, anecdotes, and real-world examples make lessons memorable.

- Timeless principles — lessons remain relevant across markets and economies.

- Short, digestible chapters — easy to read without heavy jargon.

- Broad audience — applicable to both beginners and seasoned investors.

❌ Cons

- Not a step-by-step “how-to” guide — some readers may want more actionable financial tactics.

- Some chapters overlap in theme, leading to repetition.

- Primarily U.S.-centric references, though lessons are universal.

Who Should Read The Psychology of Money?

This book is best suited for:

- Beginners intimidated by traditional finance books who want to start with the mindset.

- Seasoned investors seeking a reminder that behaviour often trumps strategy.

- Anyone prone to financial stress, greed, or short-term thinking.

- Readers who enjoy stories and philosophy rather than charts and formulas.

If you’re looking for a step-by-step budgeting or investing manual, this isn’t the book. But if you want to transform the way you think about money, it’s one of the most powerful reads available.

Reception & Impact

Since its release in 2020, The Psychology of Money has sold over 5 million copies worldwide and has been translated into dozens of languages. It is widely cited as one of the best personal finance books of the past decade, often recommended alongside classics like Rich Dad Poor Dad and The Millionaire Next Door.

Final Verdict: Is It Worth Reading?

Absolutely.

The Psychology of Money isn’t about budgets or stock picks — it’s about building the right mindset to sustain wealth over the long term. Its lessons are timeless, deeply human, and often counterintuitive.

👉 Best for readers who want to master the emotional side of money and make smarter decisions for the long run.

Quick Summary

Rating: ★★★★★ (4.8/5)

Title: The Psychology of Money

Author: Morgan Housel

Publisher: Harriman House

Published: 2020

Length: 256 pages

Best For: Beginners, investors, mindset-focused readers